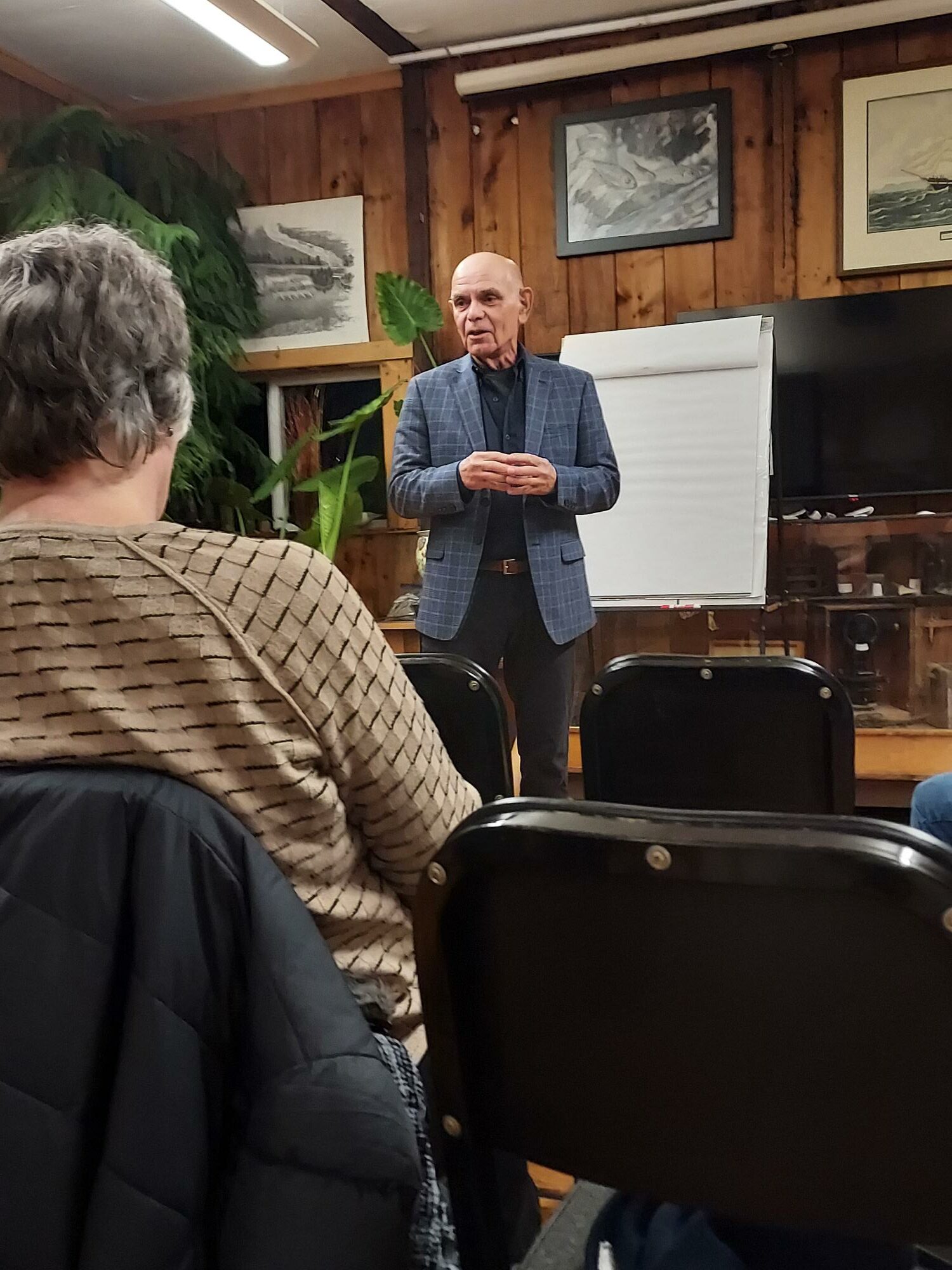

Robert (Bobby) C. Miller, a North Falmouth, MA resident, has been Field Operations Manager

of Plymouth Solar Energy. In his role, Miller acts as the liaison and point person between the customer, solar installers and solar equipment suppliers. He also assists with determining the configuration of each solar energy system and participates in service/maintenance calls for existing solar systems.

Plymouth Solar (PlymouthSolarEnergy.com ) is a regional leader in the installation and maintenance of commercial and residential solar and battery systems.

Miller is a Coast Guard veteran and held the rank of Petty Officer Second Class. His eight-year service included maintenance of buoys and island-based communication and lighting. He also assisted with search and rescue. He is a native of Tehachapi, California.

Plymouth Solar (PlymouthSolarEnergy.com ) is a regional leader in the installation and maintenance of commercial and residential solar and battery systems. The company boasts over 200 installed and on-line monitored solar systems within 50 miles of Plymouth.

Plymouth Solar Energy is located at 18 Main Street Extension, Plymouth, MA. There are now 10 full and part-time staffers at the growing entity.

For more info visit www.PlymouthSolarEnergy.com . For a complimentary Solar Feasibility Study or questions, call (508) 746-5430 or email info@plymouthsolarenergy.com.

Robert C. Miller named Field Operations Manager for Plymouth Solar Energy.Read More

Follow Us!